Life is very unpredictable and sometime you will find yourself in a situation where managing your expenses is not possible without getting some extra cash. And it can be more tougher if you are struggling with your credit score. But don’t worry, if you are searching for “no credit check loans“, you are reading the right article. We will provide you all details about what are the options you have and how you will find a right loan for yourself.

What Are No Credit Check Loans?

When lenders do not consider your credit score as key indicator to provide loans to you and instead they only review your income and ability to repay, they are known as No credit check loans. they are often short term loans with comparatively lesser amounts.

When to Choose a No Credit Check Loans?

You may consider this type of loan if:

- Your credit score is low or doesn’t exist.

- You want to avoid about any short term loan into your credit score report.

- You need urgently and quickly for an emergency.

Common types of No Credit Check Loans

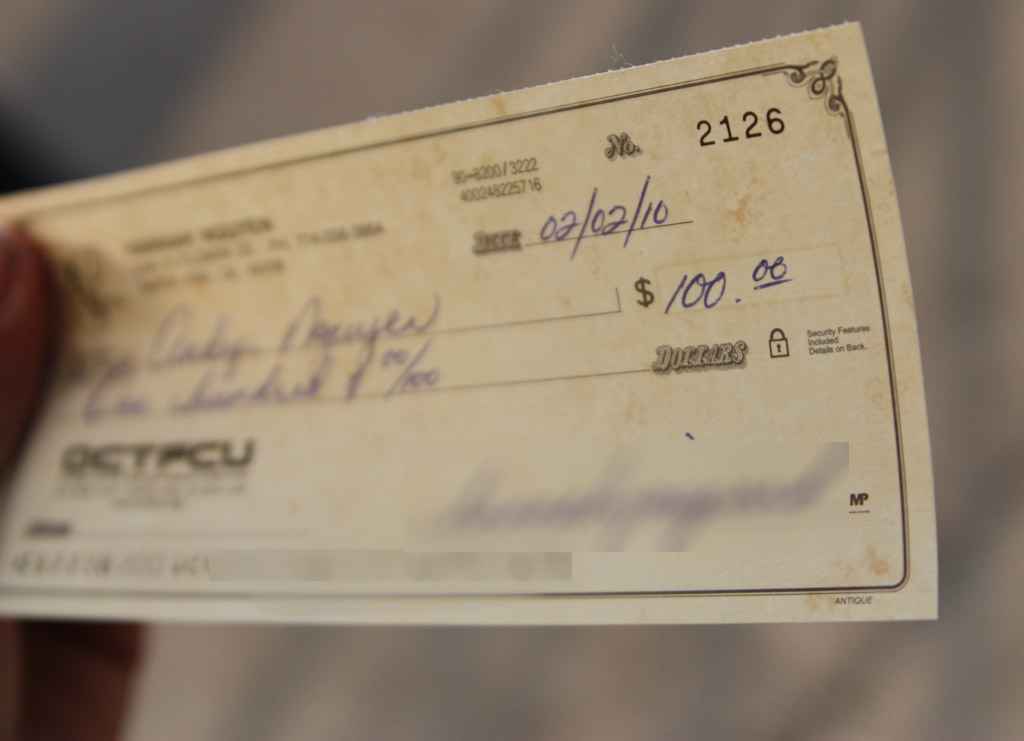

1. Payday Loans

Payday loans are small as well as short term loans. You have to repay them when you will be getting your next pay check. They usually have high interest rates.

2. Title Loans

You have to provide your car title as collateral for this loan type. You can borrow a larger amount, but you risk losing your car if you don’t pay back the loan.

3. Installment Loans

Installment loans let you borrow money and repay in fixed payments over time. They are more flexible than payday loans.

4. Cash Advance

They are similar to payday loans and some lenders offer them on your paycheck. They are quick but usually have high interest rates.

How Do You Find No Credit Check Loans?

Local Payday Loan Stores

You need to check for payday loan stores in your area. Many of them offer no credit check loans.

Check Online

You should check it online where many websites are providing no credit check loans. You can apply and often get approved with in minutes.

Credit Union

If you are a member of any credit union, You should check with them. They also offer small amount loans to their members. They also do not check your credit scores to give you loans.

Community Services

Local organizations also provide emergency loans for people in need.

How to Apply For a No Credit Check Loans

Find a Lender: Check for any local payday loan store locally or search online.

Provide Your Income Proof: Show your pay stubs, current bank statements and other proofs.

Fill an Application: Fill out all your details including your full name, address & income etc.

Receive Your Money: Once your application gets approved, you will get cash or bank deposit quickly.

Things You Should Take Care Of

Even if no credit check loans are convenient and quick, there are some risks involved. Please check:

High Interest Rate: They usually comes with high interest rate and fee.

Short Repayment Terms: You may need to repay the loan quickly, sometimes in just weeks.

Predatory Lenders: Some lenders target people in financial trouble. Always read the terms.

Tips for Choosing a Lender

- Compare fees and interest rates.

- Check reviews online to ensure the lender is reputable.

- Avoid lenders who don’t provide clear terms.

- Alternatives to No Credit Check Loans

- If you’re unsure about taking a no credit check loan, consider these

No credit check loans are a lifeline for people with bad credit. They are fast and easy to get, but they come with high costs. Always research your options and choose carefully. Borrow only what you can afford to repay.